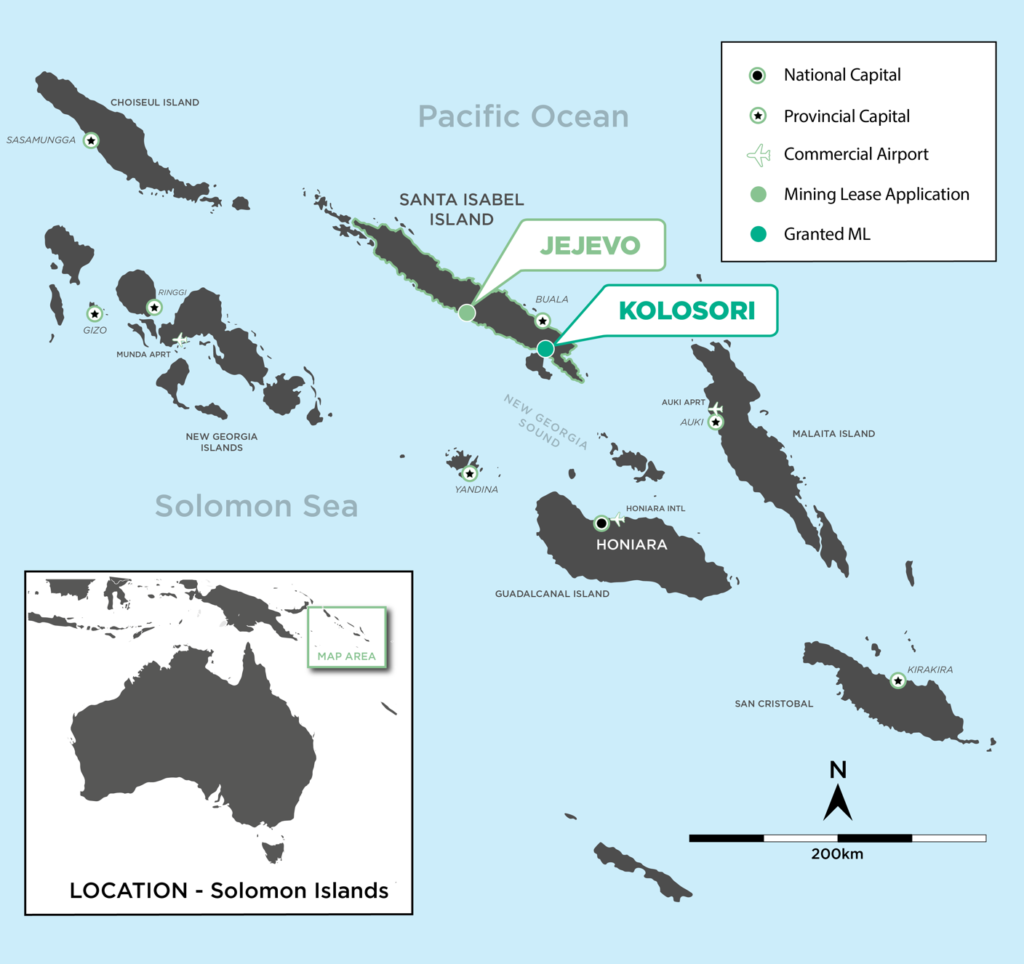

The Kolosori Nickel Project is a direct shipping ore nickel laterite project on Isabel Island in the Solomon Islands. The Company holds an 80% shareholding in Pacific Nickel Mines Kolosori Limited (“KNML”), the holding company of ML 02/22. The landowners associated with the Kolosori Project own the remaining 20% of KNML.

The Kolosori Project is a Direct Shipping Ore (DSO) with a high-grade nickel laterite Mineral Resource Estimate totalling 7.06 million tonnes at 1.57% Ni at a 1.2% Ni cut off.

Production

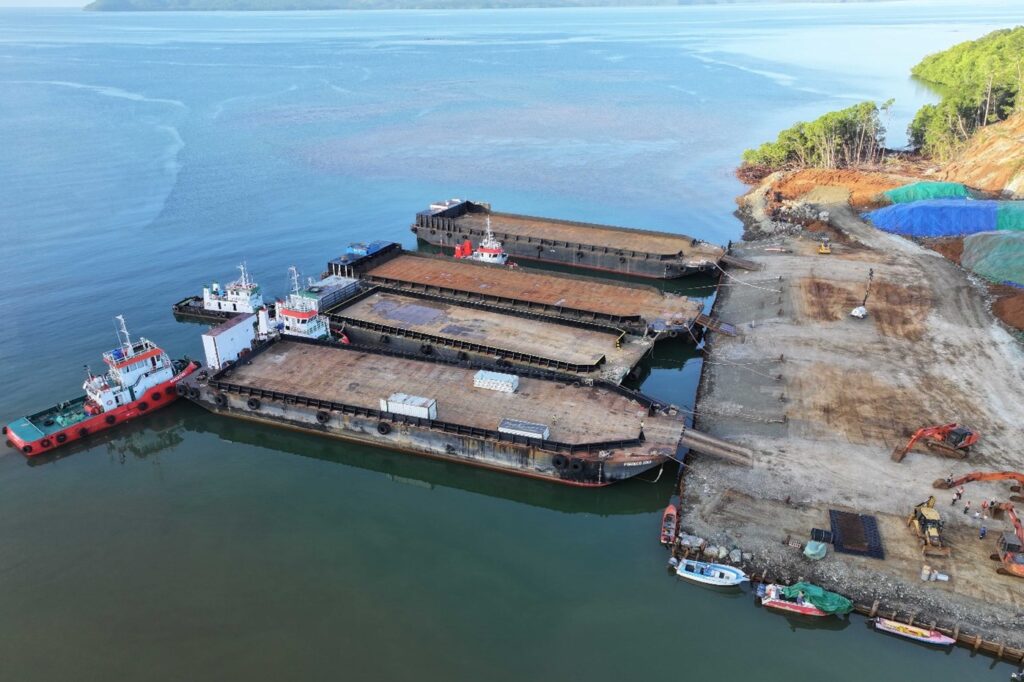

The Company began its first shipment of nickel ore in December 2023, with four 3,000t barges unloading onto a 60,000t bulk carrier arranged by its offtake partner Glencore. The average grade of the first DSO shipment is over 1.75% Ni.

Under the terms of the Offtake Agreement with Glencore, the Company receives 85% of the value of the shipment once loaded, with the balance payable upon adjudication at the discharge port

Additional stockpiles are being developed to ensure that the future shipments can be sequenced in a timely manner.

The Project is forecast to produce around 1.4 to 1.5 mtpa of nickel ore per annum over at least six years.

The Company will be carrying out exploration in 2024 to extend the mine life of the Project.

Development

Construction of the Project began in earnest in August 2023 following the arrival of the contract mining equipment from PNG via the mining contractor, HBS. A second tranche of HBS mining equipment arrived on site in September 2023 allowed the Company to utilise a two-shift (24-hour) operation to accelerate the removal of overburden and is sufficient for ore mining and loading of barges for shipment.

The Company has successfully completed all development activities with the site now fully operational.

Kolosori JORC (2012) Resource Estimate

| LITHOLOGY | RESOURCE CATEGORY | Dry Kt (‘000) | Ni % | Co % |

| TRANSITIONAL | MEASURED | 127 | 1.81 | 0.08 |

| INDICATED | 583 | 1.52 | 0.07 | |

| INFERRED | 1,300 | 1.33 | 0.07 | |

| SUB TOTAL | 2,009 | 1.51 | 0.07 | |

| SAPROLITE | MEASURED | 893 | 1.73 | 0.02 |

| INDICATED | 2,264 | 1.48 | 0.02 | |

| INFERRED | 4,040 | 1.42 | 0.02 | |

| SUB TOTAL | 7,197 | 1.48 | 0.02 | |

| TOTAL (M+I+I) | 9,206 | 1.46 | 0.03 |

Kolosori JORC MRE at a 1.0% Ni Cut off

| LITHOLOGY | RESOURCE CATEGORY | Dry Kt (‘000) | Ni % | Co % |

| TRANSITIONAL | MEASURED | 127 | 1.81 | 0.08 |

| INDICATED | 469 | 1.62 | 0.07 | |

| INFERRED | 812 | 1.48 | 0.06 | |

| SUB TOTAL | 1,408 | 1.56 | 0.07 | |

| SAPROLITE | MEASURED | 846 | 1.77 | 0.02 |

| INDICATED | 1,833 | 1.57 | 0.02 | |

| INFERRED | 2,989 | 1.53 | 0.02 | |

| SUB TOTAL | 5,668 | 1.58 | 0.02 | |

| TOTAL (M+I+I) | 7,076 | 1.57 | 0.03 |

Kolosori JORC MRE at a 1.2% Ni Cut off